How Real Estate Investment Has Evolved in Recent Years

October 16, 2025

How Real Estate Investment Has Evolved in Recent Years

The real estate sector has seen dramatic changes lately—with growth in investment, shifts in buyer and investor behavior, technology adoption, policy reforms, and increasingly diverse real estate offerings. Below are some of the most important trends and what they mean for anyone considering real estate investment today.

Changing Landscape: What’s New and What’s Growing

- Strong Investment Inflows: Domestic & Institutional Surge

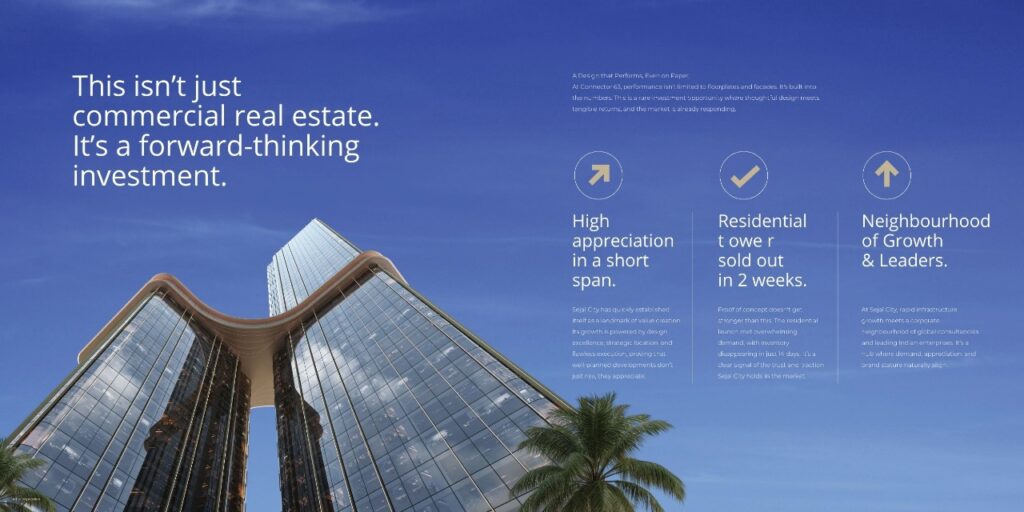

Real estate in India has attracted increasing amounts of private equity and institutional capital. In 2024, institutional investments reached US$ 8.9 billion across 78 deals—smashing previous records and signalling rising investor confidence.Domestic as well as foreign players are participating, including foreign direct investment (FDI) and Private Equity (PE) funds - Premium and Luxury Segment Gaining Ground

Demand for premium and luxury housing has been accelerating. Many new launches are in properties priced high, with amenities, quality finishes, and prestige becoming more important than just “space.” For instance, homes priced ₹1 crore and above are seeing much more demand. - Affordable Housing Still a Key Driver

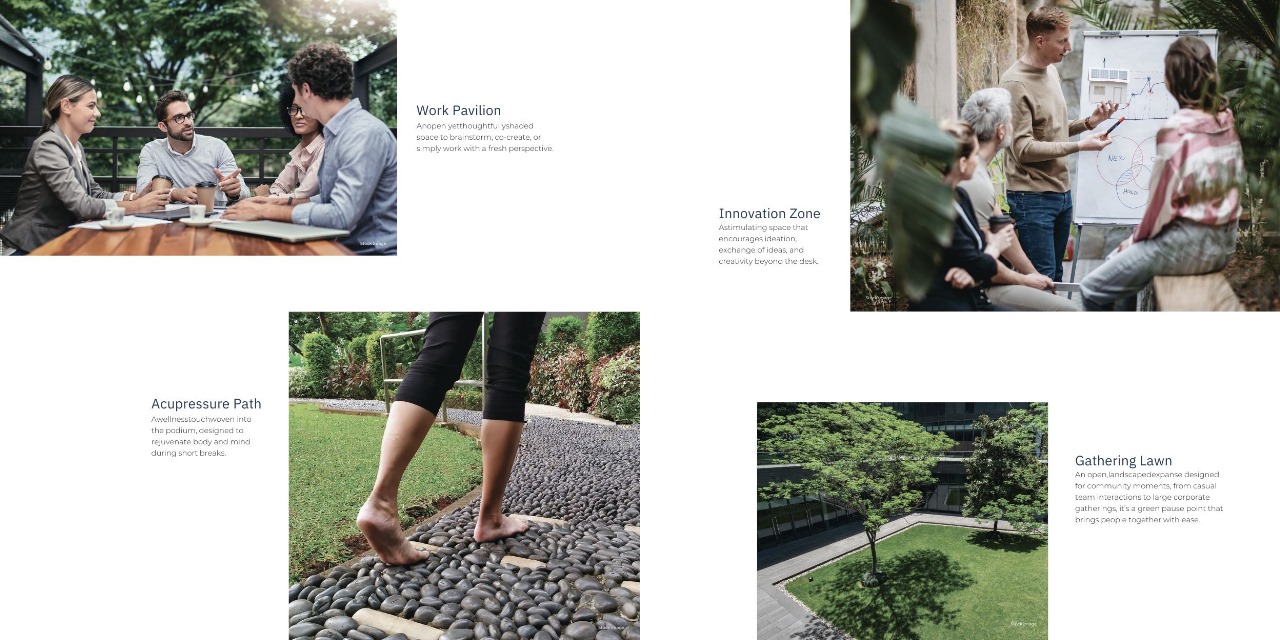

Alongside luxury, the affordable housing segment remains central—thanks to policy support and rising urbanization. The government’s schemes (like PMAY) help stimulate supply and buyer demand. Mid-income and first-time buyers are especially active in outskirts of large cities and Tier-2/3 cities. - Rise of Commercial, Logistics & Flex Spaces

The demand for commercial real estate (especially Grade A offices) has rebounded post-pandemic. Corporations, Global Capability Centers (GCCs), and flex office operators are leasing large spaces again.

Also, industrial and logistics real estate—warehousing, fulfillment centers—are growing fast due to e-commerce boom and supply-chain demands.

Key Drivers Behind the Change

- Policy & Regulatory Reforms

Regulation like RERA (Real Estate Regulatory Authority), better transparency, relaxed norms for foreign investment, tax benefits and incentives have increased trust among buyers and investors. These reforms reduce risk of delays, irregularities, title issues etc., which historically deterred investments. - Improved Infrastructure & Urbanization

As cities expand, infrastructure—roads, metro, airports—connectivity, amenities—has improved. This not only increases land value but opens up new locations for residential and commercial projects. Urban migration and demand for better living standards push growth. - Technology and Digitisation

Technology is playing a major role: from property search, virtual tours, e-agreements, to property management and marketing. Blockchain and digitization help improve title verification and transparency. Smart homes, IoT etc. are more in demand. - Shifting Investor and Buyer Preferences

Buyers are more quality-conscious: amenities, trust, timely delivery, reputation of builder matter more. Investors are looking beyond just capital appreciation—rental yield, maintenance, utility, green credentials etc. Also, many NRIs are investing increasingly in Indian real estate, especially luxury/high-end projects.

Challenges & Considerations

- Rising construction costs / input prices (cement, steel, labour) affect margins and final price.

- Land acquisition in prime locations remains difficult and expensive; regulatory approvals still take time.

- Market cycles, interest rates, inflation can influence affordability and investor sentiment.

Conclusion

Real estate investment has grown far beyond being just land or building speculation. It is now a more organized, regulated, debt-and equity-driven arena with multiple segments, technology, and higher expectations from both buyers and investors. Those who invest intelligently—by understanding these changes, balancing risk, choosing trusted partners, and picking locations wisely—stand to benefit. For many, real estate today is not just about owning property; it’s about owning opportunity.